Private client portfolios have already largely recovered from the market slump triggered by Donald Trump’s Rose Garden tariffs speech on 2 April, analysis from Asset Risk Consultants (ARC) has shown.

According to ARC’s latest data, the average return of the ARC Sterling Steady Growth Index for May, based on the most common risk profile run by discretionary investment managers, is estimated to be 2.8%, resulting in year-to-date performance of -0.4%.

ARC said May saw a continuation of the rebound from the April lows, with confidence boosted by the 90-day reduction in US-China tariffs and better-than-expected earnings announcements from US corporate heavyweights like Nvidia.

Global equities rose close to 6% in the month when measured in US dollars.

See also: IHT receipts continue to rocket as government eyes further hikes

Investors with a bias towards growth were “back in the ascendency”, ARC said, with global growth stocks outperforming their value counterparts by around 6%.

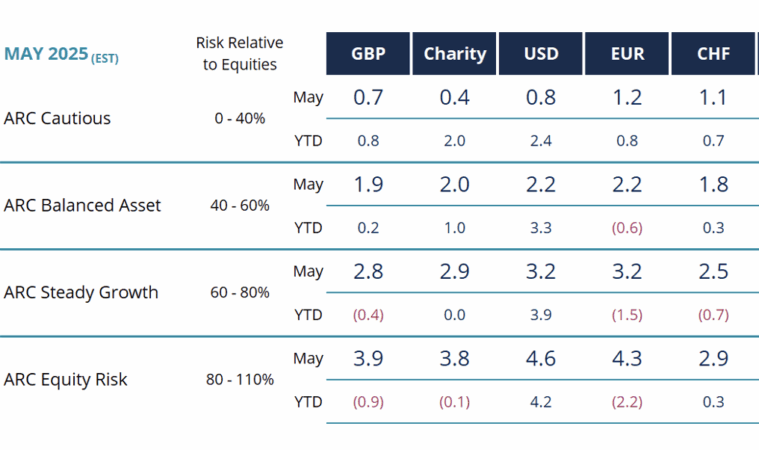

The full performance data table for the ARC portfolios can be seen below:

Dan Hurdley, managing director of ARC Research, said: “As Benjamin Graham observed more than half a century ago, in the short run the stock market is a voting machine rather than a weighing machine.

“The recovery in stock markets during May perhaps reflects a re-assessment of the economic damage that the US may cause in aggressively pursuing autarky.

See also: Schroders finds IHT pension pot grab front of mind for advisers

Despite the positive momentum in the equities market, Hurdley issued a note of caution.

“However, this is not a time for investors to relax, as in the longer-term stock markets behave like weighing machines and the reversal of global liberalisation will inevitably bring slower economic growth, higher budget deficits and lower corporate profitability,” he said.

“Those investors who have until recently enjoyed the benefits of being ‘risk-on’ should probably be considering a move to a ‘risk-neutral’ position for their portfolios. Ignore the recent market tremors at your peril.”