It has been a rocky year for the world of mini-bonds, which has been turned upside down since the collapse of London Capital & Finance (LCF) in 2019.

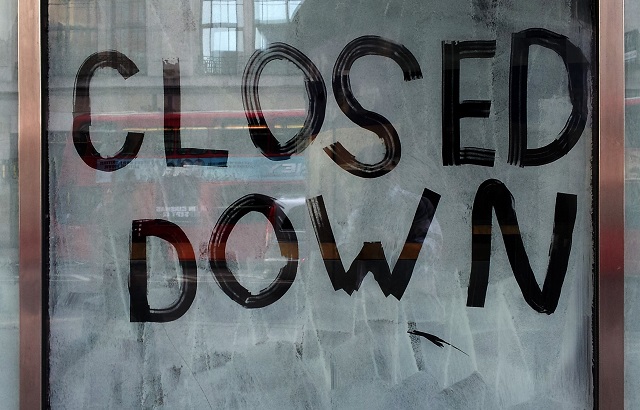

Many firms shut down after an extensive probe from financial regulators and fraud officials, with Blackmore Bonds the latest addition to the list.

Blackmore raised money from retail clients to invest into property, starting at a minimum lump sum of £5,000 ($6,160, €5,680).

But most of the development sites it was supposed to fund have barely even started construction.

Client upheaval

On 22 April 2020, Geoff Bouchier and Benjamin Wiles of Duff & Phelps were named joint administrators for Blackmore Bonds.

They said the value of the current outstanding bonds totals around £45m.

The firm’s bondholders have not received coupon payments since October 2019, despite Blackmore’s directors stating on several occasions this year that they would resolve the situation.

But clients were not convinced, so a representative bondholder issued a winding up petition against the company.

When the security trustee for the investment firm became aware of the petition, it reached out to Duff & Phelps and appointed it as administrator for the business.

Bouchier said: “There has been concern regarding the company’s affairs for several months, so it will be a relief for bondholders that independent professionals have now been appointed to the company.

“We are immediately undertaking a review of the properties and will immediately commence an investigation into the company financial position.”

A long road ahead

Blackmore bondholders are unlikely to get much comfort if they turn to the LCF victims to gauge what the process could involve.

The Financial Services Compensation Scheme (FSCS) has, so far, only identified 1% of the roughly 11,600 investors as being eligible for its help.

It has prompted the group to turn to website Crowdfunding to raise money to take the lifeboat scheme to court.