AJ Bell has hiked cash interest rates and cut trading fees, just hours after the Financial Conduct Authority (FCA) criticised platforms for the rates received on cash balances.

Taking effect from 1 April 2024, trading fees to buy and sell investments on the firm’s D2C platform will drop to £5 per trade, down from £9.95. Frequent traders, meanwhile, will see charges reduce from £4.95 to £3.50 per trade.

Meanwhile, interest rates have been increased on larger amounts of cash held in ISAs, SIPP and pension drawdowns. It is also introducing higher rates of interest paid on large cash balances held in both ISAs and pensions in accumulation of 2.70% and 3.95% respectively.

For cash held in pension drawdown, the firm has ranging from 3.45% for balances below £10,000 to 4.45% for balances over £100,000.

To read more on this topic, visit: Nucleus reduces platform charges for the second time

Michael Summersgill, chief executive officer at AJ Bell, said the platform had been planning the pricing change ‘for some time’.

He said: “Now we have clarity from the regulator, we are pleased to confirm another significant package of pricing changes which will benefit our customers to the tune of £14m a year. It is clear platforms are able to use cross subsidies where they do so to deliver fair value to customers across their entire proposition.

“So, as well as improving the competitive rates of interest we pay, we are also reducing our dealing charges for D2C customers and reducing the custody charges advised customers pay.

“The financial impact is fully factored into the guidance we provided in our annual results last week and our enhanced competitive position puts us in a great place to continue to grow our market share.”

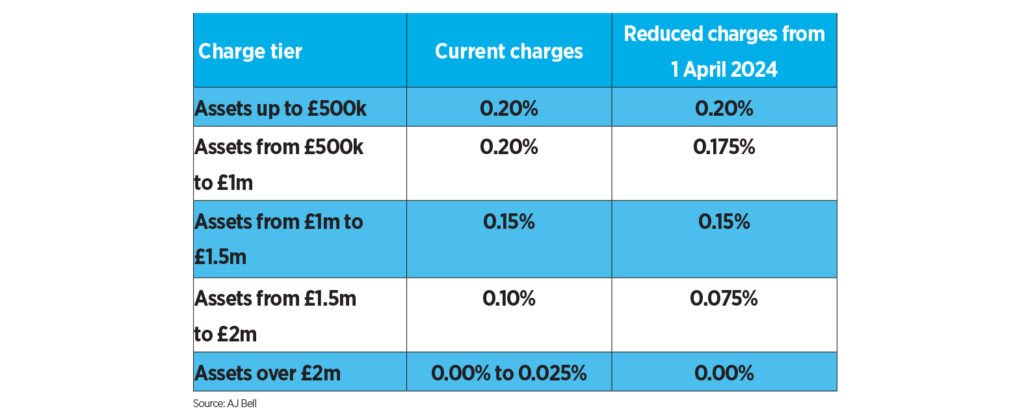

On advised platform charges, the changes are as follows:

The announcement comes hours after the FCA announced it had written to investment platforms expressing concern over interest received on cash balances.

The watchdog pointed out that the Bank of England has raised the base rate significantly over the past 18 months, and as of June 2023 the 42 firms it surveyed had collectively earned £74.3m from holding customer cash.

It said this figure “may not reasonably reflect the cost to firms of managing the cash”. The watchdog also pointed out that many platforms also charge a fee to customers for the cash they hold, a practice it described as “double dipping”.

Platforms have until 29 February 2024 to address the issue voluntarily, or the watchdog will take action.

This article first appeared on our sister publication Portfolio Adviser.