‘Keep it simple, stupid’ is a fairly brutal but straightforward way of reminding people that complexity is not your friend.

But after many years of ‘in the mystery lies the margin’, it’s refreshing to see growing numbers of financial advisers adopt the Kiss philosophy; with the Aegon Adviser Attitudes Report 2021 finding that a staggering 75% of them avoid complex strategies altogether.

Richard Whitehall, head of portfolio management, credited the introduction of Prod and Mifid II with driving the change, as they “challenged the industry to be more transparent about the benefits, risks and charges associated with investment products and to demonstrate how these meet customers needs”.

He added: “Their reasons very much chime with our own rationale for avoiding them in our portfolios.”

Number crunching

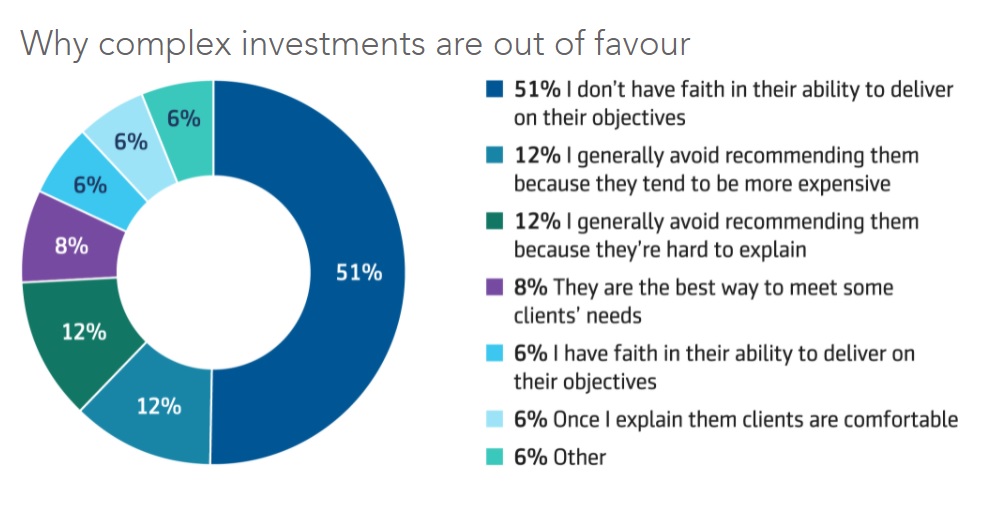

The biggest reason cited by half of the respondents was that they did not have faith in the ability of complex investments to deliver on their objectives.

Whitehall added: “A raft of absolute return and complex products launched following the 2008 financial crisis and have struggled to compete with more conventional multi-asset strategies in the long, bull market that followed.

“The volatility caused by the outbreak of the coronavirus appears to have been short-lived, and so didn’t help the case for complex solutions.”

Cost and difficulty explaining the products to clients were the joint second most common reasons for avoiding them.

Not fully out of favour

Of the advisers who do use complex investments, the most common reason cited was that they are the best way to meet some clients’ needs.

Just 6% had faith in their ability to delivery on their objectives, while a similar number said that their clients are comfortable with complex investments once they have been explained.

Whitehall commented: “The fact that advisers have turned their back of complex investments doesn’t come as a surprise in the current environment. While they’re aiming to do very different things, looking at the risk and return profile of absolute return strategies alongside simpler, multi-asset portfolios, what worries me is the dispersion of returns and risk in the sector.

“It’s my belief that today’s investors are a great deal more cost conscious and want to see value for money from their investments. At this point in time, it’s hard to see this coming from complex investments.”