Advisers and wealth managers have a great opportunity to build deeper human relationships with clients in ways many haven’t yet embraced.

Recent research by Oxford Risk shows that many advisers claim to understand their clients’ psychology well. Yet the same survey shows 70% of advisers are surprised by clients’ behaviours. This suggests they can enrich their understanding of investors’ personalities and behaviours, for the benefit of their clients, themselves, and their companies.

Other studies show these benefits could be huge.

The challenge with current processes

Many advice processes still treat clients like robots, trying to force them into “technically correct” solutions without understanding the behavioural barriers to optimal outcomes.

Most approaches assume advisers simply need to discuss clients’ financial circumstances and give them a risk tolerance questionnaire, which spits out the “perfect” asset allocation and portfolio solution.

But these “right solutions” can quickly go wrong if they ignore what each investor is comfortable with, and their ability to stay the course. Traditional approaches do not account for clients feeling so afraid of moving 100% into unfamiliar stocks and bonds that they put it off completely, nor the possibility of being diverted from the right path by fight-or-flight reflexes to short-term news stories.

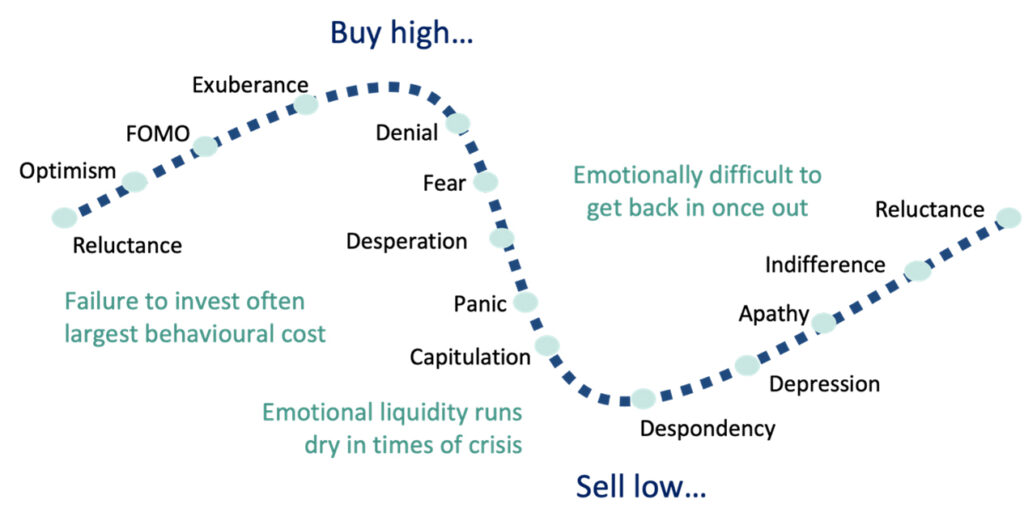

Clients need to stay invested even through pandemics, wars, and market crashes. They also need to avoid the temptation to increase risk in their investment portfolios during soaring bull markets, or to follow ill-judged advice from social media, news, friends or family.

This requires an understanding of financial personality well beyond a simple risk tolerance questionnaire. Often investors need to reach the “right answer” via a series of more comfortable steps, and a behavioural guidance system can keep them on track.

The role of personality

Studies show the cost of behavioural errors is between 3% and 4% a year. The biggest part of this comes from missing long-term investment returns by staying in cash simply because it feels safe, which typically costs 4% to 5% a year on the uninvested cash. If 50% of assets are in cash, which is common, that equates to 2% to 2.5% overall in missed returns.

The remaining errors come from emotionally-led decisions people make once invested and throughout their financial journey, which typically cost people a further 1% to 1.5% per year on invested cash.

Being underinvested could happen for many behavioural reasons, such as anxiety about market conditions, lack of confidence making financial decisions, or fear of repeating past mistakes.

See also: Revealed: All the winners of the IA Best Practice Adviser Awards

Biased investment decisions can also arise from a range of personality-linked behaviours, such as wanting to invest in familiar assets, chase past performance, or prioritise income over returns.

Investors also tend to follow comfortable narratives such as “I got it right last time, I know what I’m doing”, or “my brother knows about finance, he told me to do this”. The common factor in all these behaviours is that investors are acting in ways that make them comfortable in the moment, but at the cost of long-term returns.

When you study the emotions investors can go through over the investment journey, you can see how feelings dominate the process – from reluctance to optimism, excitement, denial, fear, insecurity, panic, and even apathy.

Treating clients more like humans involves recognising how personality traits play into this rollercoaster to help intervene at the right moments. It helps advisers identify what emotions are pulling an investor off course and how to remedy that. Then it helps move them towards the right path contextually in a way that maintains emotional comfort and likely leads to much better financial outcomes over time.

Behavioural finance isn’t just about telling clients what the right portfolio is, but speaking to them in a way that, given your knowledge of their personality, lowers their behavioural barriers to it.

How to be more human-centred

This more humanised journey could involve a vast number of different approaches. For some, it may begin with drip feeding into the market; for others, it might mean starting with some home bias; or it might involve sustainable investing.

Classical finance tells us drip feeding is technically inefficient. But if the alternative is doing nothing, it’s a good way to start and add emotional comfort for someone who fears investing.

Investing 100% into home country assets might reduce diversification, but if it helps persuade a client to move out of cash, that’s a good first step. You can build international diversification later.

Allaying ethical concerns with a sustainable/ESG approach can also break down barriers to investment.

It’s critical to understand what these different comfortable steps will be for each person you advise. In Anna Karenina, Tolstoy wrote, “all happy families are alike; each unhappy family is unhappy in its own way.” Humans are unique in their individual flaws and inefficiencies. Though the right answer is the same for most people, the emotional barriers they need to overcome to get there are different.

Greg B Davies, PhD, is head of Behavioural Finance, Oxford Risk