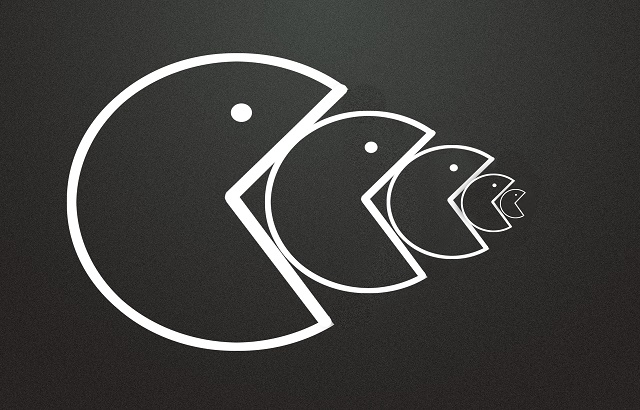

The M&A financial advice market is beginning to be made up of all different types of outfits.

From the consolidator giants of IWP and Fairstone to the likes of acquisition hungry Saltus Group.

All firms want to be part of the M&A merry-go-round but have their own strategies and ideas about the types of businesses to buy and how the deals will be structured.

Mike Stimpson, partner at Saltus Group, says the firm is firmly looking at cultural fit, which is why it is less M&A active than its counterparts in the advice space.

He told International Adviser: “The M&A market in our sector is so interesting at the moment, and I think the reality is that everyone is involved in it, whether you want to be or not. If you’re not involved in it by looking to be potentially an acquirer, then you’re very possibly going to be acquired.

“When we talk about being an acquirer of choice, we’re not a consolidator. We’re not just looking to gather assets for the sake of it. But selectively, for the right type of businesses, we can pay top dollar and work with vendors to find the right exit for them. That helps us in our growth plans as well.

“M&A is great in lots of ways, and particularly in our industry with what’s going on at the moment, there’s a huge opportunity. There’s also this massive risk of getting it wrong from a culture point of view, and doing the wrong deal with the wrong people who don’t see things the same way.

“Destroying your culture can happen quite quickly with certainly a couple of bad deals, or even one. So, we are trying to find not just the right business in terms of numbers, Ebitda and what multiple you’re paying, but also who’s going to fit.

“We think quite carefully about that cultural side of M&A, which is, I guess, why we do less deals than the big guys.”

Competition

Over the past few years, there seems to have been a new consolidator entering the UK financial advice market each week.

But this creates competition for firms like Saltus to attract financial planning companies.

Stimpson said: “It’s definitely competitive. There are lots and lots of potential buyers of these businesses. I think, for us, we tend to be looking for something slightly different. In a race with a consolidator where you’re just looking at who can pay the sort of biggest multiple, that’s not a fight we’re ever going to get ourselves into.

“What we’re looking for is the business where we can add more value than anyone else. With the last acquisition we did of Fish Financial, they were in the process of thinking about building their own platform and getting their own DFM permissions and building out effectively what we’ve spent the last five years building out.

“So we can talk to them, ‘we’ve kind of been down this path, this is what it looks like, we actually started as an investment management business so that’s our bread and butter’.

“There aren’t that many people who seem to be offering the same overall package that we have in this space. If you can’t differentiate yourself, then you’re just talking about who’s going to pay the most money.

“Cultural fit is a really big differentiator. If the vendors are going to stay in the business, going from being the boss to reporting to someone else, it will be different. Most of the time you set up your business because you don’t want to report to someone else anymore, and so finding someone who you really think you can work with is very important.

“It tends to work both ways. If we think it’s not really going to work for us, then it’s probably not going to work for them either. I think that’s one way that you can differentiate yourself.

“The other is that the speed of consolidation, at times from some of the larger players, means that actually integrating those acquisitions is something that either doesn’t get done or gets done in a slightly haphazard fashion.”

Preparing for a sale

Sometimes, success in the M&A market isn’t always about how good the acquirer is at doing deals.

Sellers need to prepare well for a sale and give their proposed acquirer a good understanding of their business in the due diligence process.

Stimpson added: “How a firm makes itself attractive to potential buyers is dependent on who that buyer is.

“If it is a typical consolidator then substantially cutting all operating costs to maximise profits, cleaning up your files and data and not having any defined benefit transfer liability will all go a long way to making your firm an attractive proposition.

“When it comes to firms like us, who are more interested in additional value creation to share with vendors, the steps are slightly different.

“We would recommend holding as many assets as possible on wrap platforms, having a single centralised investment process which most clients follow and having as little as possible AuM with third party DFMs, where the assets are custodied with that DFM, though there would be no issue with using a third party MPS.”

M&A growth strategy

Saltus has shown over the last couple of years that it is using the M&A advice market as a way of growing the business.

The Fish Financial deal in September 2021 followed the acquisitions of Consilia in March 2021 and Lorica in 2020.

But the firm is not setting targets for the number of deals it wants to do or what assets under management it wants to achieve at a certain date.

Stimpson said: “We’ve created quite a lot of value through M&A over the last few years, and we want to continue to do that, and we think the market place is rife with opportunity. We talk to an awful lot of people, but because we do have a differentiated pitch there are lots of people it doesn’t work for at all, and only a small handful that it does work for.

“We’re always having conversations; do we think we’ll do another deal this year? Possibly. We’re in due diligence. Would we like to do more deals next year? Yes, but I can’t give you a number. We don’t think about it in that way.

“We try and find the right opportunities at the right time. The integration is really important. We’re not interested in buying businesses, and then not integrating them properly and having problems down the line.

“We do look UK-wide. I think, in general, if there is a business that is reasonably close to one of our offices, then we can look to do a bolt-on acquisition. If it’s further away from our other operations, then it would need to be a larger business so that it can then become a hub in that area.

“We look at different businesses depending on where they are, but we’ll look all over the place. We do want to become a regional player across the UK.”