Mid-cap stocks are being overlooked by investors and could offer an “attractive sweet spot” amid current market volatility, according to Aberdeen.

The asset manager looked at data going back to 2009 and found that globally, mid caps are trading at record low valuations compared with large firms, despite the fact they have provided better returns than their larger peers over the past 25 years and could provide diversification from US mega cap stocks.

Aberdeen noted the MSCI ACWI Mid-Cap Index consists of companies with a typical market cap of $10bn to $40bn, though market capitalisation of mid-sized companies varies significantly by geography.

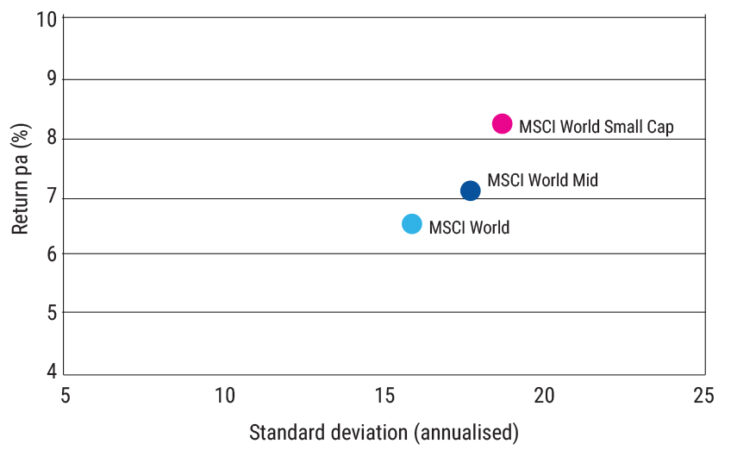

The firm said this part of the stockmarket offers the potential for higher returns than large caps, but with lower levels of risk than small caps.

Over a 25-year period to 27 April 2025, the average growth of the MSCI World Mid-Cap Index was higher than for the MSCI World Large-Cap Index, as shown in the chart below.

Anjli Shah, manager of the abrdn SICAV I – Global Mid-Cap Equity Fund, said: “Globally mid caps have long been overlooked and under-loved by investors. Still today there are only a handful of global funds that focus exclusively on this part of the market. But, considering the diversification benefits they offer, now may be the time for investors to consider introducing a specific allocation to mid-caps into their portfolios.

See also: Only one in three advisers view in-person new client meetings as essential

“For companies to have made it from small to mid cap, they tend to have established and resilient business models while remaining nimble. Thus, mid caps can potentially offer lower levels of risk than small caps.

“Despite these attractive characteristics, market inefficiencies still exist. Mid caps are often under-researched and under-covered versus large caps. These market inefficiencies present an opportunity for us to find hidden gems.”

See also: Eyes on AI as investors look for clues on market recovery

Rebecca Maclean, co-manager of the Dunedin Income Growth Investment Trust, added: “We see numerous compelling opportunities among UK mid caps for long-term investors. Recent market turmoil and slowing global growth have renewed investor attention on the UK mid-cap sector, which offers superior earnings growth, a stronger domestic focus, and a persistent valuation gap relative to large caps.

“UK mid caps provide distinct advantages over the FTSE 100, where earnings are predominantly generated overseas. In contrast, 50% of FTSE 250 revenues come from the UK, making them more closely aligned with domestic economic trends.”