Funds from Crux Asset Management and Somerset Capital have been named and shamed in the latest Spot the Dog report, which saw a surprising number of previous poor performers turn their fortunes around.

Bestinvest called out 31 persistently underperforming “dog” funds in the latest edition of its twice-yearly report. Collectively holding £10.7bn ($12.9bn, €12.7bn) of assets, it estimates the current pack of dogs is raking in more than £115m in annual fees.

To wind up in the kennel, funds must have failed to beat the benchmark over three consecutive 12-month periods and have underperformed the benchmark by 5% or more over the entire three-year period of analysis.

Despite the turbulent market environment this year, the number of ‘pawful’ pooches was less than half of the 86 funds named and shamed in the previous report, which held £45.4bn of investors’ savings.

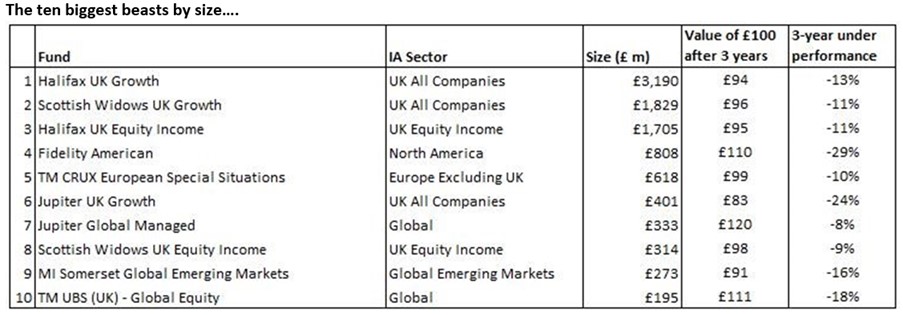

Still, there were three ‘Great Danes’ with over £1bn in assets on the list – Halifax UK Growth, Scottish Widows UK Growth and Halifax UK Equity Income. The trio of mutts are advised by Schroders and have repeatedly been in the doghouse.

Schroders had the unenviable distinction of having the most dog funds on Bestinvest’s list at five, despite only one of its own named brand products – Schroder European Sustainable Equity – featuring among the worst offenders.

While Fidelity only had one disobedient dog – Fidelity American – it was the fourth biggest beast on the list with £808m in assets and one of the 10 worst performers overall, down 29% against its benchmark over three years.

Crux and Somerset funds in the doghouse

While Bestinvest’s hall of shame was dominated by larger listed asset managers, it noted that several funds from boutique managers had wound up in the kennel in the latest report.

The Crux European Special Situations and European funds, run by Richard Pease and James Milne, were called out for trailing their benchmarks by -11% and 6% respectively on a relative three-year basis. The former, which

has £618m in assets, was one of the top five underperforming beasts in terms of fund size.

Source: Bestinvest

Though Bestinvest noted the funds’ underperformance is less severe, it has been consistent, adding “the group prides itself on its stock-picking skill and should be able to thrive in all conditions”.

“The repeat appearance of the Crux European funds on the list will be worrying for those investors that have backed the popular ex-Janus Henderson star Richard Pease and his team,” it said in the report. “The group’s European funds have now failed to keep pace in both value and growth markets, which suggests there is something awry.”

Responding to the report, Milne and Pease flagged the team’s long-term track record. In its various guises, Crux European Special Situations has returned 203% versus 144% for the IA Europe ex-UK peer group, with outperformance chiefly driven by stock-picking in mid-caps.

However, they admitted “recent performance has not been so good”. During the first year of the pandemic, the fund fell behind due to its deliberate lack of exposure to growth or “dream stocks,” which saw multiples rocket. And it missed out on some of the upside from the huge value rotation in 2021-2022, which chiefly benefited deep value, such as energy stocks, which the fund is underweight.

“Both of these market climates were highly unusual and in both cases, the fundamentals that we focus on were ignored by investors; in particular return on capital: the loss-making Covid-19 beneficiaries names never made a profit, and the value names almost by definition make a low return,” Pease and Milne said. “As this unusual period draws to a close, the funds are beginning to see green shoots as investors once again look at resilient, well-run, capital-light business models.”

Somerset, the emerging markets outfit co-founded by Jacob Rees-Mogg, was also home to two dog funds. The Somerset Global Emerging Markets and Global Emerging Markets Screened funds were 16% and 14% behind their peer group over three years.

Bestinvest said the boutique has suffered from its value style approach being out of favour and though there have been “tentative improvements over the very short term” it has “a lot of ground to make up”.

Oliver Crawley, head of marketing at Somerset, said: “Emerging Markets have had to contend with a lot of volatility in recent years, but this has created a huge number of opportunities for bottom-up, fundamental stockpickers.

“It’s early days but the tide does appear to be turning in China, where the easing of Covid restrictions and the onset of stimulus are easing concerns over growth. China is home to many high-quality companies with significant growth potential, and we are able to invest in these businesses at the moment at historically low valuations.”

Turnaround for SJP and Invesco

Behind Schroders, Jupiter had the highest number of dog funds at three with £774.7m in assets. These include Jupiter UK Growth, Jupiter Global Managed and Jupiter Asian.

While this was lower than the six funds the FTSE 250 manager had in the kennel in the previous report, Bestinvest said the fact the trio of laggards are all different to last time’s offenders “suggests there are a large number of funds flirting with inclusion”.

But there were notable improvements elsewhere from former top dogs. St James’s Place, which previously had six funds on the list, including two big beasts – the £3.1bn Global Equity and £1.3bn Global funds – had only its Continental Europe fund in the doghouse.

Abrdn, which tied with SJP and Jupiter for greatest number of poorly performing pooches last time, only had two dog funds with £135m between them.

Invesco, which had £5bn across four unruly canines last time, had zero in the latest edition, and Bestinvest noted JP Morgan, BNY Mellon and M&G had also improved their performance.

UK and global funds go to the dogs

All sectors recorded a drop in the number of poor performers. But global equity income funds enjoyed the biggest comeback, dropping from 14 dog funds in the last report to zero.

Jason Hollands, managing director, said many of the perennial underperformers that had dominated its list were able to catch a break as funds investing in undervalued companies and dividend payers came back in favour.

“With inflation surging, borrowing costs rising and the war in Ukraine, sectors like energy, commodities, consumer staples and healthcare have had a much better run of performance compared to ‘growth’ sectors like technology, communications services and consumer discretionary companies that previously delivered stellar returns,” Hollands said.

UK-focused funds were responsible for £7.6bn or 70% of the “total assets under canine management”.

But IA Global accounted for nearly a third of the 31 dog funds and was home to two thirds of the 10 worst-performing beasts overall.

Martin Currie Global Unconstrained was the worst relative performer, with the fund lagging its index by -34% over the three-year period, turning £100 into £94 over the three years.

For more insight on UK wealth management, please click on www.portfolio-adviser.com