The UK government will formally introduce a Financial Services and Markets Bill, after it was announced on 10 May 2022 in the Queen’s Speech at the state opening of parliament.

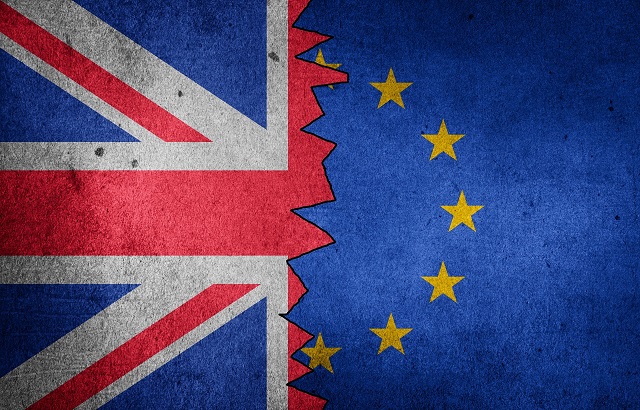

Within the bill, the UK is looking to build on the Financial Services Act 2021, which was the first step in amending the UK’s regulatory regime outside of the EU.

The UK government said the Financial Services and Markets Bill will revoke retained EU law on financial services and replace “it with an approach to regulation that is designed for the UK”.

This includes Solvency II legislation governing the regulation of insurers and updating the objectives of the financial services regulators to ensure a greater focus on growth and international competitiveness.

The bill will also look to introduce additional protections for people investing or using financial products, and to make it safer and support the victims of scams.

The UK government added: “The bill will make the most of the opportunities of Brexit, by establishing a coherent, agile and internationally-respected approach to financial services regulation that is right for the UK. More details will be available when the bill is formally introduced.”

Address the advice/guidance boundary

Tom Selby, head of retirement policy at AJ Bell, said: “The introduction of the Consumer Duty has the potential to transform UK financial services for the better.

“By moving from rules-based to outcomes-based regulation, firms should be able to focus more on introducing interventions and prompts that help customers make better financial decisions. However, the effectiveness of this regulatory shift risks being undermined by the lack of clarity over the advice/guidance boundary.

“This lack of clarity means firms who do not wish to offer advice tend to steer well clear of anything that brings them close to the regulatory perimeter. As a result, millions of non-advised customers are receiving less support than might otherwise be the case, meaning they are more at risk of making poor saving or retirement decisions.

“The new Financial Services Bill provides a legislative platform to rethink that paradigm. Addressing this issue would fit neatly into the Government’s flagship ‘levelling-up’ agenda, as it is those on lower incomes who cannot afford advice who most benefit from guidance. If guidance could be beefed up, non-advised savers would be in a better position to achieve their long-term goals.”

Steven Cameron, pensions director at Aegon, added: “Many already benefit from financial advice, but for some this may be disproportionately expensive. Current rules make it very difficult for firms to offer anything between generic information and full regulated advice.

“As we adjust to a UK outside of the EU, there’s an opportunity to move away from EU regulations and open up new forms of support, allowing the financial services industry to help more people. We’re strongly in favour of regulated firms being able to offer a more personalised form of guidance, which would nudge them in a positive direction, acting in their interest, without recommending any specific product.”

Better settlement for retail investors

Anne Fairweather, head of government affairs and public policy at Hargreaves Lansdown, said: “As the government looks to right size financial services legislation for the UK post Brexit in the Financial Services Bill, Hargreaves Lansdown are calling for a better settlement for retail investors.

“From better access to IPOs to harnessing the opportunities of innovative technologies to allow firms to use data to better guide clients, this is an opportunity to update our rules for future. We welcome the focus on tackling scams and believe that clients will be better protected with more personalised relevant guidance from firms they know and trust.”