Brewin Dolphin Ireland is offering its investment management services to British expat clients who have found themselves without a UK wealth manager now that Britain has left the EU.

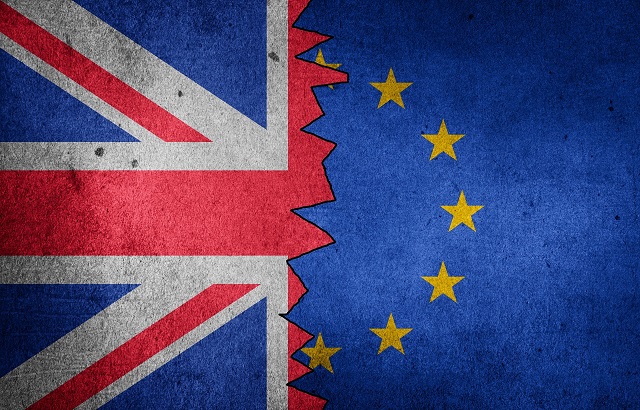

Brexit legislation in December 2020 ended financial services passporting between the UK and the EU. As Brewin Dolphin Ireland remains within the Union, it can continue to provide its expat clients with general investment management services and certain products, including Isas.

From its offices in Dublin and Cork, the business will continue to deal with UK expats living in the 27 countries within the EU.

The wealth manager said it “is already gaining expat clients from a number of wealth managers in the UK who do not have an EU-based business, including clients from the Brewin Dolphin business in the UK”.

‘Doors open’

Hal Catherwood, chairman of the board for Brewin Dolphin Ireland, said: “We’re fortunate to have our offices in Ireland with investment managers that are already operating within the EU.

“We’re able to stand by our existing expat clients and we will continue to look after them. Our doors are also open for orphaned clients who no longer have a financial adviser.”

Eddie Clarke, chief executive of Brewin Dolphin Ireland, added: “British people who have chosen to live, work or retire in the EU shouldn’t be penalised or cut off from access to the type of style and approach to discretionary investment management and advice that they have relied upon for decades.

“Having reviewed the new regulatory landscape, we believe we can continue to offer those same individuals a consistent service along with all the comfort of a familiar UK name.”

This news comes shortly after International Adviser reported that Ian Kloss joined the wealth manager as head of nationals, networks and international distribution.