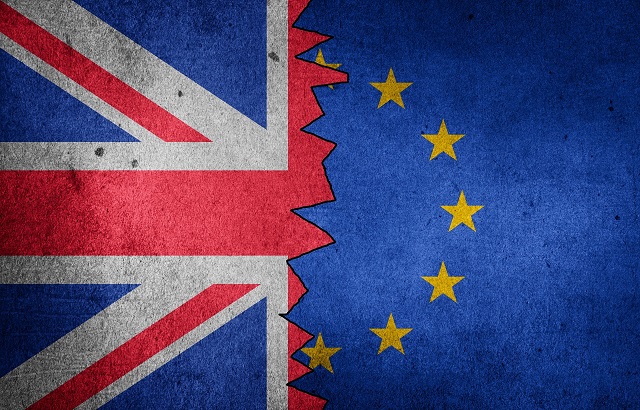

On the day of the Brexit trade deal, there was one question in the minds of many in industry: where is financial services?

Unfortunately, the deal on 24 December 2020 failed to deliver a long-term relationship between the UK and EU financial services markets.

It means firms on both sides have to rely on temporary structures based on its previous arrangement for a couple of months.

But once this period is over, the UK will be free to make to make its own choices.

But to get better access to the bloc’s market, Britain may have to regulatorily align itself to the EU.

‘Rule-taker’

On 6 January 2020, Andrew Bailey, former Financial Conduct Authority (FCA) chief executive and current Bank of England governor, told the treasury select committee that the UK shouldn’t submit to the EU’s financial services rules after Brexit.

He said that Britain must not become a mere “taker” of EU rules in return for access.

“If the price of this is too high then we can’t just go for it whatever,” he told parliament’s Treasury Committee,” Bailey said. “I strongly recommend that we don’t become a rule-taker. If the price of that is no equivalence … then I am afraid that will follow.”

International Adviser spoke to Neil Jones, tax and estate planning specialist at Canada Life, about post-Brexit regulation in the UK and he said that regulatory alignment was likely.

Jones said: “I think there’s probably things higher on the agenda for the government rather than changing legislation that is already on the books because I know we adopted on EU legislation when we left.

“If we want to carry on trading and doing business with Europe, then we’re going to have to have legislation that is going to be on an equal footing.

“I can’t see them to changing anything in the short term or even in the medium term because we want to make sure that we still have trading partners.”

Cut red tape

The pros of Brexit have always been that the UK can make its own rules and not have to stick 100% to regulations of other countries or institutions.

And according to the Times, UK prime minister Boris Johnson believes the “time is now” to deregulate Britain’s economy.

But doing so may end up cutting much needed ties with the EU financial services market.

Reports said that Johnson invited business leaders to propose areas where his government can cut red tape.

He reportedly said he is “committed to working with British businesses to realise the vast opportunities on offer as the UK forges an independent future” outside of the EU.

The next couple of months will be pivotal in the UK’s financial services market, as a trade deal could be the difference between financial regulatory divergence and alignment.