Independent Wealth Planners UK (IWP) is expected to launch a national brand in 2020 with over £2bn ($2.58bn, €2.33bn) of client assets.

IWP is majority owned and controlled by its management team.

Launch members will include a dozen independent financial advisory firms, four of which joined earlier this year.

They include Alexander Grace, Kelsall Steele Investment Services, Murdoch Asset Management and Rixons Wealth Management, giving IWP a presence from Cornwall to Yorkshire.

Another eight firms are already signed up and currently going through the acquisition process, resulting in the IWP firms having total projected total client assets of over £2bn in Q1 2020.

The firm intends to establish a nationwide presence with about 50 offices and is currently in “active discussions” with over 20 regional IFA firms, in addition to the 12 already announced.

Support

IWP provides operational and support services, including compliance, IT, investment research, marketing, recruitment and training, allowing IFAs to spend more time with clients.

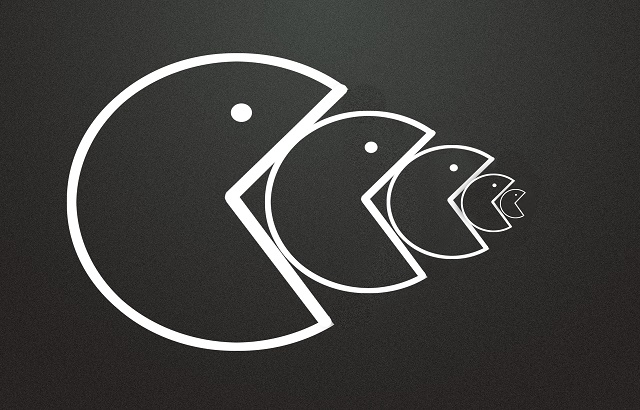

It acquires firms but leaves day-to-day management in the hands of local teams, who may also retain a participation in the ownership of the business.

The firms retain their brands, whilst sharing an IWP master brand.

David Inglesfield, IWP chief executive, said: “We have had huge interest in IWP; many IFA owners tell us that they are keen to secure their business’s future, and value the infrastructure support we bring.

“As a long-term investor in the sector, we have a client-centric strategy and a strong belief in the skills and expertise of the staff whose firms we acquire.

“Our role is to support them and to provide the resources to allow them to grow.

“We are here to build Britain’s best independent wealth planning business – but we’re not trying to build it from scratch; there’s no need, because it already exists, in the many excellent local firms around the country.

“What we do is give them the scale and support to flourish, and to come together as a national firm whilst retaining the local autonomy which makes them special.”

Inglesfield was previously head of wealth at UK-headquartered Kingswood.

Tech matters

In an environment where the ever-changing regulatory and technology landscape is putting more pressure on the UK IFA community, smaller independent firms are coming under increasing pressure.

Firms are forced to dedicate scarce time and resources to maintaining compliance standards, keeping up with IT, and maintaining investment research, marketing, recruitment and other necessities.

IWP’s chief operating officer, Tony Spain, said: “Many firm owners tell us that they love their job insofar as it relates to advising clients; but they find it increasingly difficult to keep up with the managerial and administrative burdens of running a regulated firm.

“Our role is to provide national-quality support to help firms maintain the highest operating standards whilst giving them more time to focus on their clients.”

Spain was previously at HSBC Retail Banking and Wealth Management as senior product manager.