Markets have been in dismay following Donald Trump’s sweeping tariff announcements, with the S&P 500 dropping 12.1% in the week after.

A 90-day pause on enforcing higher tariff rates saw the US index recover 9.5% on Wednesday, but the brash trade policy is set to create uncertainty for months to come.

Many investors are therefore looking to make their portfolios more resilient, especially considering how large of an allocation the US has become to most.

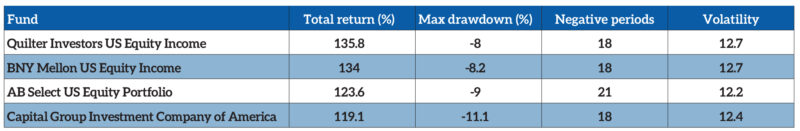

Our sister publication Portfolio Adviser identified four US equity funds that delivered top-quartile returns over the past five years whilst still offering some of the sturdiest defensiveness from market drawdowns.

They had the shallowest maximum drawdowns, fewest number of negative periods, and lowest volatility compared to their peers in the IA North America sector, yet still made some of the highest returns.

IA North America funds with top-quartile returns, maximum drawdowns, negative periods and volatility over the past five years

The highest return came from Quilter Investors US Equity Income, which was up 135.8% over the past five years. It outperformed its peer group by 33 percentage points over the period, yet had the fewest number of negative periods than all other US equity funds.

It was down in 18 of the 60 months over the past five years, compared to 23 for its average peer, meaning investors had greater peace of mind knowing that their savings were making positive returns month-on-month.

Also to grow investors’ capital in 42 of the past 60 months was BNY Mellon US Equity Income, which made a top-quartile return of 134% over the period.

It did so whilst also falling the least, with a maximum drawdown of just 8.2%. This is half of the 16.7% maximum drawdown experienced by the average US equity fund, so investors were shielded from the worst declines, even in downward markets.

See also: Markets on a knife-edge as tariff headlines prompt wild swings and Treasury yields jump

Analysts at Square Mile noted that it has a differentiated composition to most US equity funds thanks to its value focus. It has a 9% exposure to technology, for example, compared to 30.7% for the S&P 500 benchmark.

Managers John Bailerat, Brian Ferguson, and Keith Howell only invest in companies with dividends that are at least 50% in excess of the S&P 500. The fund therefore offers an abnormally high yield of 2%, with most US equity funds only offering 0.6% on average.

Square Mile researchers said it can “be used as part of a diversified allocation to North American equities” and would appeal to “investors with a yield requirement”.

See also: Stocks surge and yields stabilise as Trump tariffs paused

Alternatively, investors who have become more cautious in light of global tariffs may want to consider the AB Select US Equity Portfolio.

It beat its peers with a 123.5% return over the past five years, yet did so with some of the least volatility of 12.2. By comparison, the average US equity funds had a volatility ranking of 15.5 over the period.

Another defensive US fund to deliver top-quartile returns was the Capital Group Investment Company of America. It was up 119.1% over the past five years compared to a 102.8% return from its average peer, yet still had some of the lowest maximum drawdowns, negative periods and volatility.

This story was written by our sister title, Portfolio Adviser