In recent years, we have seen them emergence and interest pick up in wider diversified multi-asset portfolios rather than the traditional simple 60/40 portfolio. There are two key trends as to why diversification is back in vogue.

First, the continued challenging macro environment, with uncertainty set to continue, has seen advisers looking for more portfolio resilience for their clients. Following 2022 negative correlated environments, many advisers for the first time are looking beyond bonds to help them with portfolio resilience with many clients opting to move in cash like solutions. Most advisers understand this is not a long-term solution for their client’s investments and are therefore a seeking support from their investment managers across the asset classes.

Second, with Consumer Duty and regulatory reviews such as the FCA’s Thematic review of Retirement Income Advice, many advisers are looking for different types of solutions for their client needs. As such other investment objectives (such as the need for flexible income in retirement) mean the asset classes and strategic asset allocations used in multi-asset solutions look very different from the traditional simply low cost 60/40 equity/bond portfolios.

A well-diversified portfolio can help cushion the impact of market downturns while providing flexibility to navigate changing economic conditions. In market conditions where seeking strong equity exposure to benefit from buoyant markets is no longer the objective, re-thinking and re-educating on diversification is key.

Diversification can take many forms – across asset classes (equities, bonds, alternatives), geographies (domestic versus international markets), and sectors (technology, healthcare, energy, etc.). By spreading exposure across different sources of return, investors can mitigate risks associated with any single market, sector or asset class.

A typical multi-asset portfolio blends three key components:

- Equities – the primary engine of long-term growth, offering capital appreciation and dividend income.

- Bonds – traditionally seen as the stabiliser, providing income and acting as a counterbalance to equity market volatility.

- Alternatives – a broad category that includes assets that can enhance risk-adjusted returns but often come with higher fees and lower liquidity.

The key questions we are supporting advisers with are outlined below:

1. Are global equities truly diversified?

The US dominates global equity markets and there has been much discussion on the magnificent seven individually and collectively in the US market. The US accounts for 63.3% of total market share, while other major economies such as the UK and China make up just 3.1% and 2.4%, respectively. Given this imbalance, investors question whether their global exposure is as diverse as it appears, or whether the global portfolios are just US biased portfolios.

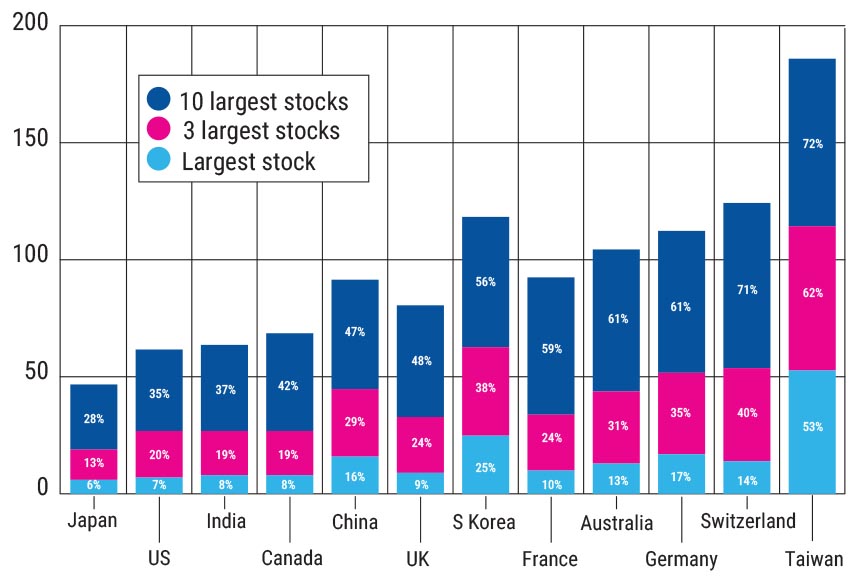

If we look at the 12 largest equity markets, we measured the percentage of total market capitalisation held by the top 10, top three, and single largest stock in each country (see bar chart below). The US is one of the least concentrated markets. Switzerland stands out as one of the most concentrated markets, highlighting how some national indices rely heavily on a few dominant players. Taiwan’s numbers stand out because it is overwhelmingly dependent on one company – Taiwan Semiconductor Manufacturing Company (TSMC) – which alone accounts for 53% of the country’s total market cap.

Concentration within the world’s 12 largest equity markets (percent of total)

Looking at equity exposure through a purely geographical lens can also be misleading. A US listing does not necessarily mean a company’s business is US-centric. Many of the world’s largest US-listed firms – particularly in the technology sector – derive a significant portion of their revenues (ca 53%) from markets outside of the US.

2. Can bonds really protect a multi-asset portfolio?

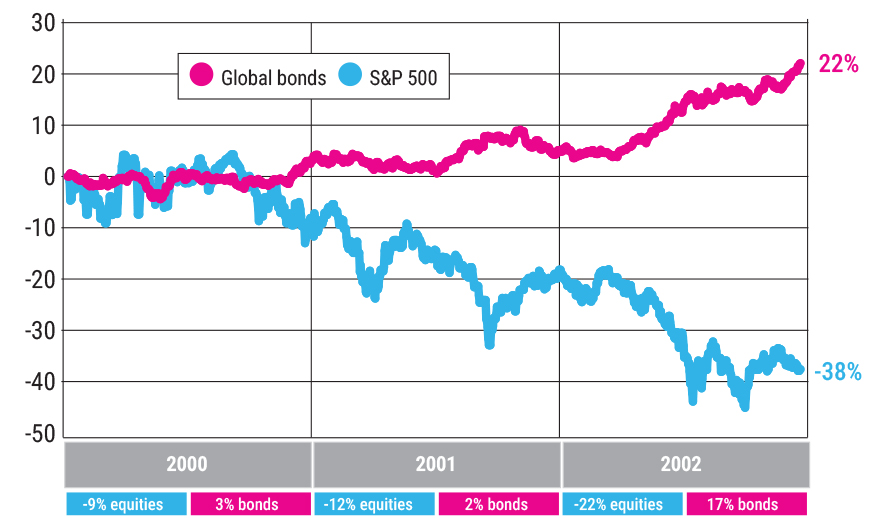

When equity markets experience drawdowns, investors often turn to bonds for protection. Looking back at the early 2000s, the S&P 500 posted consecutive annual declines, falling 9% in 2000, 12% in 2000, and 22% in 2001. Meanwhile, global bonds delivered positive returns, providing a critical buffer for multi-asset portfolios (see line chart below).

Equity and fixed income performance, 2000-2002 (return percent)

Since 2000, global sovereign bonds have consistently provided downside protection in equity sell-offs. Even in 2022, which has since been termed by some industry commentators as the ‘worst year’ for fixed income in recent memory, having greater diversification within fixed income would have had a relatively beneficial impact on performance of a multi-asset fund. Across the eight largest equity drawdowns, global bonds have generated positive returns, offering investors much-needed resilience. This pattern has played out repeatedly, reinforcing the role of bonds as a counterweight to equity volatility.

3. Do alternatives improve the risk‑return profile?

In 2020, as inflation began to increase, equities and bonds started to move in the same direction, weakening the diversification benefits of a traditional 60/40 portfolio. Rising interest rates and inflation shocks led to simultaneous declines across both asset classes, leaving investors with fewer places to hide. With equity‑bond correlations shifting, the need for alternative sources of diversification has never been more relevant.

Alternative assets, which can include real assets (such as infrastructure and real estate), private credit, hedge funds, and commodities can be used as an additional source of diversification within a multi-asset portfolio.

But how do alternatives impact portfolio performance? Analysing a traditional 60/40 portfolio and comparing it with a portfolio that includes alternatives highlights the benefits. The data shows that adding alternatives such as gold and absolute return type strategies can reduce volatility, can improve annualised returns and improve risk-adjusted performance. This suggests that incorporating alternatives can strengthen portfolio resilience, particularly when traditional asset correlations rise or during key stages of client needs.

Conclusion

Building a resilient multi-asset portfolio requires looking beyond simple allocations. Experience over different market cycles and in-depth knowledge of clients as well as a thoughtful approach – balancing equities, fixed income and alternatives – can help investors navigate uncertainty, capitalise on opportunities across market cycles and provide different solutions depending on client needs.

In an era of changing correlations and evolving risks, true diversification remains the cornerstone of successful multi-asset investing.

Smera Ashraf is head of global wealth, UK, at Aviva Investors