Asset Risk Consultants (ARC) has published research indicating allocating by sector offers more scope for diversification than by country or region.

The consultancy said factors including the rise of the magnificent seven stocks, globalisation and market concentration has changed the investment landscape.

ARC said the dominance of the magnificent seven and the US equity market means geographic diversification benefits have been significantly reduced. This suggests leaning on it to manage risk and concentration in portfolios is not an effective strategy.

At the core of the problem is the fact that equity market performance of countries has become much more correlated.

The way to counter this, according to ARC, is to put greater focus on sector diversification as there is less correlation. This approach now provides investors with a greater chance of better performance outcomes with sector bias, ARC explained.

See more: Will the ‘year of the snake’ be prosperous for investors in Chinese stocks?

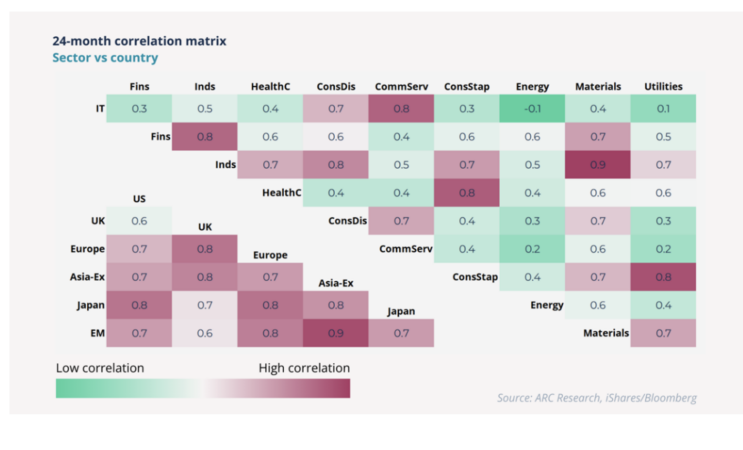

By way of example, ARC found that the correlation between the IT sector and the energy sector is -0.1. This is an inverse correlation, which the firm pointed out is ‘the holy grail of diversification’.

Other relatively weakly correlated sector pairs include utilities and IT at 0.1, financials and IT at 0.3 and healthcare and IT at 0.4.

The full table of correlations calculated by ARC can be seen below:

Shaun Le Messurier, client director at ARC Research, said: “Globalisation, the growing dominance of US stocks, personified by the magnificent seven, and high levels of market concentration makes tactical asset allocation by geography increasingly problematic.

See also: SJP aiming to ‘improve perception’ and become more attractive to advisers

“These factors have materially reduced the potential to add value through tactical tilts at the regional and country level. Given these challenges to tactical asset allocation, our analysis suggests a better starting point for investors would be global sector exposure.”

“It is time for perceptions to evolve and for sector exposure to be more carefully considered, at a minimum in parallel with geography,” he continued. “Thinking about global equity exposure through the lens of geography has become an increasingly binary approach, with the decision on the allocation to US shares dominating all other decisions.”