The six biggest advised platforms have been pulling in nearly two-thirds of all new business over the past two years, according to data from the Lang Cat.

The analysis indicates scale is a major driver of a platform’s ability to grab further market share.

In the State of the Platform Nation report, which covers 19 advised platforms, the Lang Cat highlighted ‘a clear correlation between platform size and share of new business flows’.

The top six in terms of assets under management – Quilter, Abrdn, Transact, AJ Bell, Fidelity and Aviva – appear to be dominating new business flows, further entrenching their positions.

See also: Bubble trouble: Is the stockmarket riding for a fall?

The Lang Cat also noted the gap between the largest platforms and their smaller rivals is growing, making it harder for smaller players to catch up in AUM terms through organic growth.

Other notable findings from the report included ISA withdrawals being 42.8% higher year on year. Outflows rose faster than inflows, pushing net sales for 2023 to negative £3.49bn.

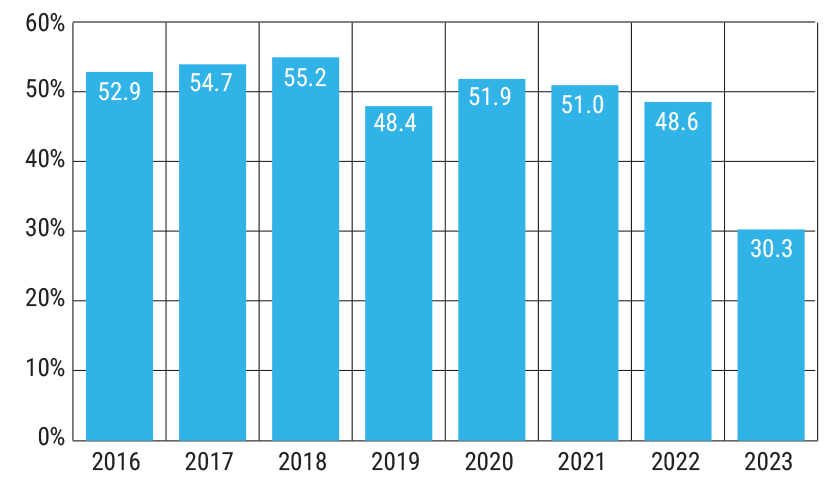

Pensions saw what the Lang Cat described as ‘the lowest ever stickiness rating’ of 30.3, down from an average of 51.8 in the previous seven years.

Net to gross ratios – Pensions

Rich Mayor (pictured), senior analyst and author of the report, said: “Our data clearly shows that, in the world of advised platforms, scale correlates to the lion’s share of new business flows and the gap between the biggest platform club and the rest of the pack is growing.

See also: Advisers expect UK equities to bounce back and property to struggle

“Plenty of smaller platforms are successful and make a good profit, but for those wanting to build scale, it’s hard to see how that can be achieved organically when the largest platforms continue to pull in most of the new business out there.

“Pensions flows onto platforms have been absolutely essential to historical platform growth due to the historically high net-to-gross ratio, so for the ‘stickiness rating’ to drop down to the low thirties is not inconsequential,” Mayor added. “If the rating has been the viscosity of honey in the past, it was more akin to water in 2023.

“Looking ahead, we expect elevated outflows across product wrappers to continue in 2024, which will present revenue challenges for platforms.”

See also: HSBC private bank arm says it’s time for clients to take on more risk