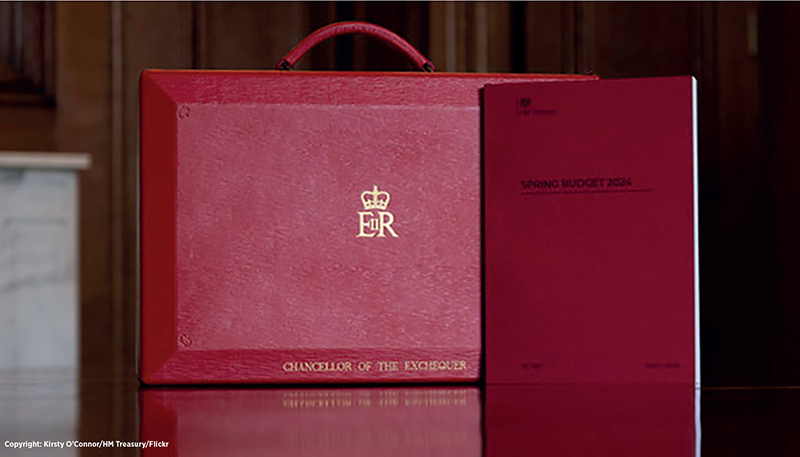

Chancellor Jeremy Hunt has announced the creation of a new British Isa to ensure UK savers can “benefit from the growth of the most promising UK businesses”.

Announced in today’s Spring Budget, the chancellor said the new British Isa will allow an additional £5,000 annual investment for investments in UK equity with all the tax advantages of other Isas.

“This will be on top of the existing Isa allowances and ensure that British savers can benefit from the growth of the most promising UK businesses as well as supporting them with the capital to help them expand,” he said.

Reacting to the announcement, Steven Cameron, pensions director at Aegon, said: “The new British Isa will appeal to those who currently max out their Isa limits, providing scope for an extra £5k tax-free saving. It will also offer transparency, appealing to those who wish to be certain their investment is staying within the UK.”

“It will be important the forthcoming consultation creates an unambiguous definition of what qualifies as a UK investment within a ‘British Isa’,” he added.

However Cameron warned that investors should be mindful about putting all their ‘eggs in one basket’.

“Diversifying across different asset types and geographical locations can be an important way of managing investment risk, something which should be emphasised to potential investors,” he said.

Rachel Griffin, tax and financial planning expert at Quilter, cautioned the introduction of the new Isa allowance raises “significant” implementation challenges and “serves to further complicate the once-simple Isa brand”.

“The Isa is a simple idea, a tax efficient place to grow your wealth, however, with various additions over the years it has now become a confusing area of personal finance,” she said. “Faced with the complexities of this consumers tend to just opt for what they know and that almost always is just a cash Isa.”

“So few people use their total Isa allowance in a given tax year too so the allure of £5,000 more is only appealing to much higher net worth people,” she added. “The reality is we need to better incentivise the millions languishing in cash Isa accounts to be put to work in the stockmarket.”

As long-term campaigners for its introduction, Mike O’Shea, chief executive of Premier Miton Investors, said the group was pleased with today’s announcement.

“Premier Miton Investors began calling for the GB Isa in September last year, because ensuring companies have access to the capital they need will encourage them to scale up and list here in the UK,” said O’Shea. “The GB Isa is a crucial step in starting to recapitalise British businesses, and make the UK listing regime the global capital of capital. We look forward to further details on the new Isa wrapper in due course.”

“We believe the British Isa (BRISA) will be an important catalyst to help reverse the trend of persistent outflows experienced by UK equity markets for a number of years,” said Natalie Bell, fund manager within the Liontrust Economic Advantage team. “It sends a vital message that the Government stands ready to back British companies, directing a proportion of taxpayer-subsidised investment towards improving employment, growth and productivity here in the UK.

“We hope that this will be supplemented in due course by other important changes, such as encouraging more domestic investment by pension funds and reviewing the significant ‘red tape’ that comes with being listed to remove anything unnecessarily burdensome,” she added. “Such initiatives would go a long way towards levelling the playing field for the UK as a primary stockmarket listing venue on the world stage.”

In addition to the launch of the British Isa, for which further details will be announced in due course, in April 2004 the government will launch the British Savings Bond, which will be delivered through National Savings and Investments (NS&I)

In the accompanying budget document, it was announced this product will offer a “guaranteed interest rate, fixed for three years, increasing the savings opportunities available to consumers”.

“The government welcomes recent market-led initiatives that open up new access routes to government financing for retail investors and will continue to examine ways in which it can support retail customers’ investment in gilts,” said the document.