The is a huge number of expat advisers in the Middle East, especially in the UAE.

But the covid-19 pandemic has been a big barrier in the search for international talent, as countries have shut their borders with only essential travel allowed, and some expats have even returned home.

In a bid to find out how much the UAE financial advice sector has been affected by the coronavirus outbreak, International Adviser asked consultancy firm Insight Discovery to conduct a survey of chief executives in the region.

Survey

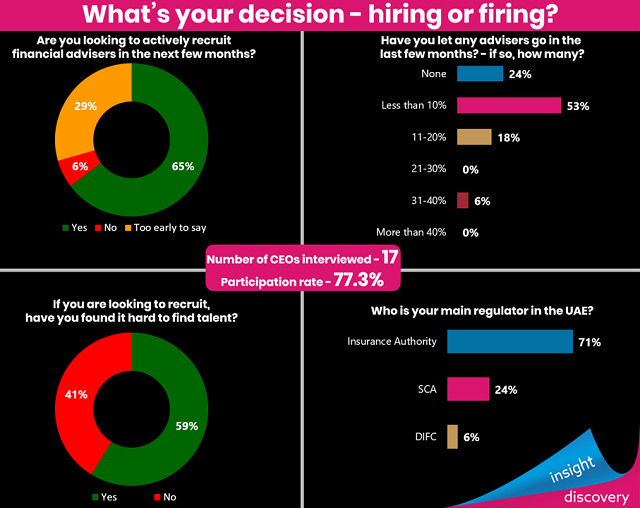

Insight Discovery surveyed 17 chief executives in June 2020 and found 65% are looking to recruit financial advisers in the next few months.

Some 28% said it was too early to say, while 6% said they weren’t looking.

Of those looking to recruit, 59% said it is difficult to find financial advisory talent.

Just over half (53%) said that they have made less than 10% of their advisers redundant, 18% said 11-20% of their advisers had gone, and just 6% said 31-40%.

Only 24% have retained all staff during the pandemic.

Source: Insight Discovery

Nigel Sillitoe, director of consultancy firm Insight Discovery, said: “What was so pleasing is that 77% of the chief executives from the largest and most influential advisory firms took the trouble to participate in our survey.

“The main takeaway was that 65% of the chief executives who participated in our survey are actively looking to recruit advisers, their dilemma however is that many of them (41%) struggle to recruit the right talent.

“It was also revealing that 24% of the firms interviewed hadn’t shed any advisers during the covid pandemic.”

How has covid-19 affected talent?

IA also spoke to several firms in the UAE financial advice sector to discuss their views on recruitment amid the outbreak.

Tim Searle, chairman of Globaleye, said: “The search for talent in the UAE has always been a challenge and covid only made that worse.”

Gaenor Jones, regional director for the Middle East and Africa at the Chartered Insurance Institute (CII) said: “The outbreak of covid-19 at the start of the year has had a very tangible impact on recruitment and access to talent in the Middle East, with the whole process having slowed considerably.

“On top of this, with the increased concerns regarding the lasting economic effects following the global lockdown, employers have had to be especially discerning when considering potential hires.”

Letting people go

The pandemic has forced businesses to reassess their strategies and has resulted in a large number of people being made redundant.

And, as the survey found, advice businesses in the UAE have unfortunately been no exception.

“We have let some people go but the travel restrictions means repatriation has been difficult and the UAE government has made it clear that the private sector has to take on the liability of keeping staff in terms of accommodation and medical cover,” Searle said.

Jones added: “The global lockdown has brought unprecedented financial pressures, and firms are having to make difficult decisions in order to protect service consistency for their clientele.

“This is especially important whilst everyone in the broader business environment is undergoing these same pressures, regardless of sector. Unfortunately, this has meant that some firms have had to resort to making redundancies.”

However, the job losses haven’t been reported by all firms in the space.

Matt Cowan, Middle East regional director at the Chartered Institute for Securities & Investment (CISI), said: “We have not heard of members being made redundant because of the pandemic, however we understand that some may have had temporary salary reductions to help businesses to cope with the sudden financial shock.”

Challenges ahead

It is an understatement to say that it will be difficult for firms to navigate through the pandemic.

Covid-19 has changed the advice space, but how much will it transform recruitment in the UAE market?

Stuart McCulloch, market head of The Fry Group Middle East, said: “The challenges we might encounter as a global brand tend to centre on the logistics of safely transferring new employees to our international offices.

“Our primary concern is the safety of employees; there is no need to make unnecessary journeys at this time.

“As an organisation, we have continued to adapt over the past few months to become even more efficient across borders with our internal and external communications.”

Advantages

CII’s Jones was also keen to point out that the region’s advantages will still be a big selling point for advisers to make the move.

She added: “The Middle East will always prove attractive to individuals who appreciate the tax advantages and lifestyle benefits the region offers, and that appeal will still be relevant post coronavirus.

“There may be some limitations immediately following the global lockdown, such as restricted travel for example, but as these conditions begin to further relax, we will see the talent influx gradually return to pre-covid levels. International talent is going to be vital to the profession in the Middle East.”

Cowan added: “What will be interesting is to see how the adviser/client relationship develops through the use of technology.

“It is entirely possible that advisers could be located in any geographical territory with advice being conducted virtually through video conferencing.”

More selective

Some financial advice firms were already increasing their professionalism, but the outbreak could push this further and more business will now look for the best advisers possible.

Recruitment will be more difficult so firms will have to be a bit pickier.

Globaleye’s Searle said it should be a given that businesses are more selective and “the propensity of quality in the post-covid new world order will make this only harder”.

“Some firms are embracing the new financial planning arena and have up skilled, changed their MO and deployed tech,” he added. “Whereas, many are still desperately holding on to out dated business models and advice offerings that the consumer does not want rammed down their throats any longer.

“Many firms have diversified into product offerings that have nothing to do with core financial planning and many in the UAE remain unregulated altogether.”

Drive for excellence

Jones said: “Firms will be seeking advisers who hold qualifications which demonstrate the highest levels of professional education and show a commitment to a reputable code of ethics and best practice.

“Advisers who have experienced adverse situations such as covid-19, and who have successfully overcome the challenges presented by these unprecedented times, will be in high demand.”

CISI’s Cowan added: “The Middle East advisory model has been developing over a number of years and firms have been seeking quality over quantity in their staffing for some time.

“The drive for quality was supported by Middle East regulators imposing minimum qualifications requirements for advisers to be licensed.

“This drive for quality will continue as there are clear regulatory and operational benefits in doing so.”

Education priority

This push for excellence has meant there will likely be more emphasis on education and qualifications.

But, as firms look to start recruiting, the next generation of advisers has been affected by the pandemic with exams and courses delayed or postponed.

So, what has coronavirus meant for adviser education?

“The greatest impact on adviser education has been the closure of examination centres, preventing individuals from sitting any exams,” Cowan said.

“But I’ve been encouraged by the large number of advisers who have used the opportunity of home quarantine and lockdown to invest in themselves, studying for CISI exams, and completing continuous professional development.”

Jones added: “The global pandemic has had a profound effect on adviser education in the Middle East.

“The interruption to the regular working routine has meant that advisers have had more time to invest in their professional development and broadening their range of skills.

“Advisers have anticipated a competitive employment environment following the global lockdown and have been proactive about engaging themselves with undertakings which provide a competitive advantage.”