The number of financial advisers in Australia has dropped to 16,671 from 26,500 between 2019 and 2022, according to research from Rainmaker Information.

This is a 37.1% fall in three years.

In the three years since the 2019 peak, the number of financial advisers registered to practices dropped by 4,200, 2,950 and 2,710, for an aggregate fall of 9,860, according to Rainmaker Information’s Financial Adviser Report.

Prior to the Australian Securities & Investments Commission (Asic) requirement that all advisers must be registered on the Asic Financial Adviser Register (FAR) by 1 January 2019, the number of advisers increased by 8,500 between 2015 and 2019.

Alex Dunnin, executive director of research at Rainmaker Information, said: “The number of registered financial advisers is now back to where it was even before the adviser registration system was introduced. All projections for adviser numbers point to no recovery without profound structural industry policy change.”

Scenarios

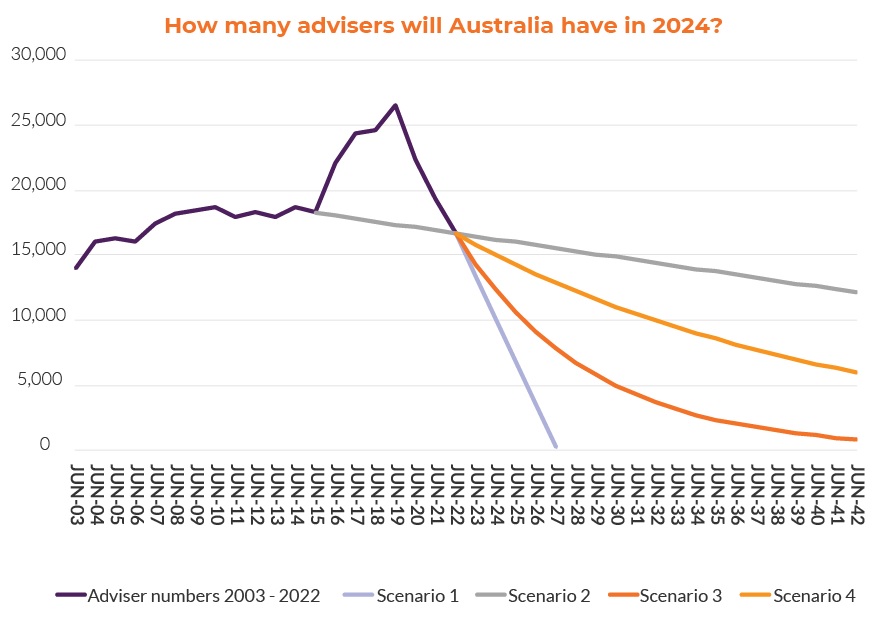

The research firm has proposed a number of scenarios which may occur within the next few years.

If this rate of decline in financial advisers continues unchecked, within five years Australia will run out financial advisers, according to scenario one by Rainmaker Information.

Source: Rainmaker Information

However, Rainmaker Information shows a more optimistic scenario with option two that suggests that the number of registered financial advisers will follow the long-run trend, but ignore the 2015-2019-2022 boom then bust.

This scenario results in the long-term forward projection that Australia in 20 years will still have about 12,000 financial advisers.

Scenario three poses what could happen if the rate of percentage fall continues at its three-year levels that averaged a loss of 14%.

This projection would see Australia’s financial adviser sector lasting through two decades, although by 2029, Australia will have fewer than 5,000 registered financial advisers—one-third its current number.

Scenario four proposes that if the number of registered financial advisers falls only 5% per annum, by 2042, there will only be 6,000 financial advisers practicing in Australia.

‘Naïve’

Dunnin added: “While these are predictions at this stage, they serve a purpose; they reinforce that the current trend of advice industry exits is so baked-in that it is naïve to expect a recovery in financial adviser numbers anytime soon. The collapse in financial adviser numbers has, counterintuitively, not been caused by the failure of its core markets of retail superannuation and platforms.

“The forces of disintermediation and divestment away from the advice sector by wealth managers has combined to impact not only the volume of funds under management (FuM) they serve, but its need for financial advisers.

“While new FuM vectors in managed accounts and ETPs are growing rapidly, its volumes are only minor in market-wide terms. This irony is that while financial advisers are strategically less important, the successful remaining ones are now much more important because in a wealth management market that is violently disrupting, funds managers need effective financial advisers more than ever.”