The Financial Services Compensation Scheme (FSCS) has confirmed that 13 firms were declared in default during December 2022 and January 2023.

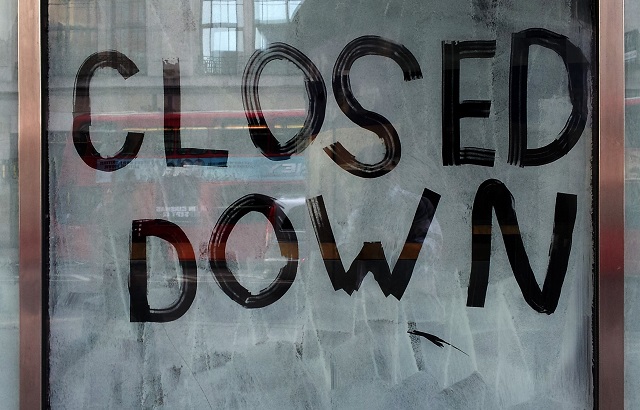

The firms have gone out of business and FSCS believes they are unable to meet any claims themselves. This means that any customers who are owed money by them can see how they’re protected. If a regulated financial firm is no longer trading and can’t pay a customer’s claim, FSCS can step in to pay compensation.

Fiona Kidy, FSCS chief financial officer, said: “Customers of financial firms that have failed or are no longer trading can make a claim to us and we’ll do all we can to compensate them.

“Our service is free, and customers keep all the compensation they’re due if they claim directly with us. So, far this financial year FSCS has handled over 90,000 claims.”

The firms include:

- Better Retirement Group Ltd formerly Directly Financial Ltd, Financial Strategy Ltd – based in Northampton;

- Aquila Financial Services – based in Barnsley;

- Broadgate Financial Management LLP – based in Billingham;

- Cadogan Asset Management Limited – based in London;

- Midhurst Asset Management Limited – based in London;

- Braemar Wealth Management NW Limited – based in Altrincham;

- Nurture Financial Planning Limited t/a Premier IFA Limited – based in Norwich;

- Vintage Investment Services t/a Vintage, Vintage Protect, Vintage Mortgages – based in Stockton-on-Tees;

- Plan Your Retirement Limited – based in Kidderminster;

- A+ Financial Services Limited t/a aplus independent financial advice, Grosvenor Trust & Saving, aplus – based in Hemel Hempstead;

- FSC Investment Services Limited formerly Ashwood Wealth Management Limited – based in Oxford;

- Craig Mitchell t/a Craig Mitchell Personal and Corporate Financial Planning – based in Hamilton; and

- Premier Wealth Management Harrogate Limited – based in Bromsgrove.